Decoding the Charges: Understanding Clear Fee Structures in Cross-Border Agency

Many shoppers feel frustrated by hidden fees when buying from overseas. You might order a product and then face extra charges you did not expect. Recent surveys show:

58% of cross-border buyers felt surprised by customs charges.

30% described these costs as shocking.

75% said hidden fees made them rethink shopping again.

When you understand the fee structure, you can plan your budget and avoid surprises. Choosing a platform with a transparent fee structure, like Fishgoo, helps you shop with confidence. Take control by learning how to spot, compare, and manage all fees.

Key Takeaways

Learn about the fees in cross-border shopping. Payment, shipping, and customs fees are important to know. This helps you plan your money better.

Pick platforms that show their fees clearly, like Fishgoo. Clear prices mean you will not find hidden costs. This makes shopping easier for you.

Always look at the full fee list before you buy. This helps you avoid surprise charges. You will feel more in control of your money.

Use package consolidation to save on shipping. Putting many items in one box can lower your fees.

Keep learning about cross-border payment fees. Knowing about transaction and currency exchange fees helps you save money.

Understanding Cross-Border Agency Fees

Types of Agency Fees

When you buy things from other countries, you might see extra fees. These fees can come from payment companies, shipping helpers, or the shopping website. Knowing about these charges helps you plan your money and avoid surprises.

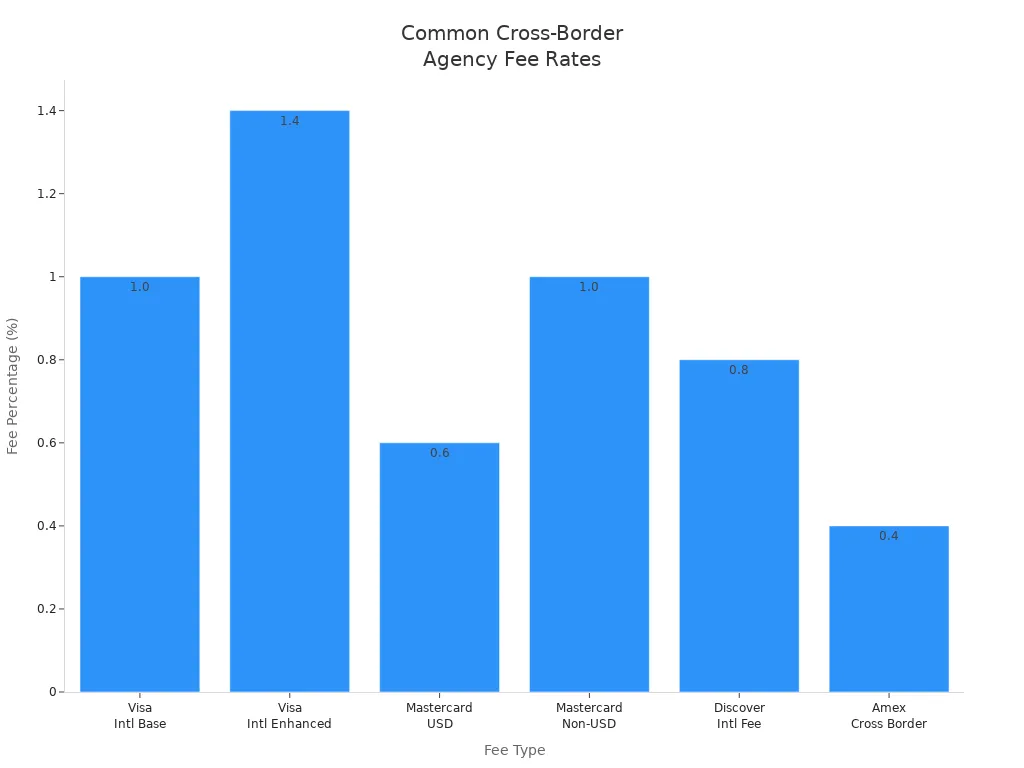

Here is a table that shows some common agency fees in cross-border shopping:

Fee Type | Percentage | Description |

|---|---|---|

Visa International Service Fee – Base | 1.00% | Applies to transactions where the merchant's country differs from the card's issuing country, settled in USD. |

Visa International Service Fee – Enhanced | 1.40% | Applies to transactions where the merchant's country differs from the card's issuing country, not settled in USD. |

Mastercard U.S. Cross Border USD | 0.60% | Applies to transactions where the merchant's country differs from the card's issuing country, settled in USD. |

Mastercard U.S. Cross Border Non-USD | 1.00% | Applies to transactions where the merchant's country differs from the card's issuing country, not settled in USD. |

Discover International Service Fee | 0.80% | Applies to card sales conducted at a U.S. merchant location where the card issuer is from another country. |

American Express Cross Border Fee | 0.40% | A flat fee often bundled into an overall international assessment fee. |

Different websites charge fees in different ways:

Borderfree uses a fee model that changes with sales and shipping places.

Global-e charges higher commission rates because it gives more services.

BigCommerce Enterprise adds international SEO features to help sellers find more buyers.

Why Transparency Matters

You want to know what you are paying for. Clear billing helps you see all fees before you pay. This makes you trust the company and want to shop again.

Studies show 70% of shoppers pick brands with clear prices. About 60% of buyers will pay more if a brand explains its prices. Companies that show their fees keep 20% more customers. In fact, 73% of people like brands that show their prices, which helps build loyalty.

Tip: Always look at the fee list before you buy. This helps you avoid surprise costs and feel calm.

If you use a platform like Fishgoo, you get clear information about all charges. This makes shopping from other countries easier and less confusing.

Transparent Fee Structure

A transparent fee structure means you know the cost before buying. You see every charge, like product price, shipping, and payment fees, right away. This helps you avoid surprises and plan your spending. For people shopping from other countries, clear information is very important. You want to trust the website and feel safe about your choices.

Fishgoo is different because it shows prices clearly. You see all costs before you pay, so there are no hidden fees. Other websites sometimes hide the real total. They might add more charges later, which makes shopping stressful. Fishgoo’s clear system lets you shop without guessing.

How It Benefits Shoppers

Using a platform with a transparent fee structure gives you many benefits. You can compare prices easily and make smart choices. You also avoid getting upset by surprise charges. Fishgoo’s way helps you feel calm and in control.

Here are some important parts of a transparent fee structure for cross-border shopping:

Currency management lets you see prices in your own money.

Banking relationships help keep payments easy and safe.

Local market presence means you get support that understands you.

Payment method optimization gives you more ways to pay.

Technology infrastructure keeps your information safe.

Compliance and risk management protect you from trouble.

Customer experience considerations make shopping simple.

Data analysis helps make the service better over time.

You get real benefits when you pick a platform with honest pricing. The table below shows how shoppers like you gain from this:

Benefit | Description |

|---|---|

Enhanced Customer Loyalty and Retention | 87% of customers are more likely to shop with a transparent company, which lowers costs and increases value over time. |

Reduced Payment Disputes and Chargebacks | Clear transaction summaries mean fewer problems, saving businesses two to three times the original cost in chargebacks. |

Competitive Differentiation | Transparency helps companies stand out and attract more shoppers. |

Improved Operational Efficiency | Clear payment systems make accounting and planning easier, helping with better decisions. |

A transparent fee structure does more than show the price. It builds trust and helps you shop smarter.

Note: Platforms with clear pricing, like Fishgoo, help you avoid confusion and make shopping from other countries easy.

Avoiding Hidden Costs

Hidden fees can make shopping hard. Many people find extra charges after they pay, like transaction fees, shipping surcharges, or storage fees. These costs often show up because some websites do not show all details at first. You might think you got a good deal, but then see more charges later.

To avoid hidden costs, always check the full fee list before buying. Look for websites that show every charge ahead of time. Fishgoo makes this easy by listing all fees clearly. You do not have to worry about extra charges after you pay.

Common hidden fees include:

Transaction fees that show up after payment.

Shipping surcharges added at the last minute.

Storage fees if items stay too long in the warehouse.

Extra costs from undervaluing items.

You can protect yourself by picking a platform with a transparent fee structure. This way, you know what you will pay and avoid surprises. Fishgoo’s clear system helps you shop with confidence and keeps your budget safe.

Freight Charges in Cross-Border Shopping

When you buy things from other countries, freight charges matter. These are the costs to move your stuff from one country to another. Many things add up to make the final price. You should know what these costs are. This helps you make good choices and plan your money.

Shipping Cost Components

Freight charges come from different places. You see these costs on your shipping bill. Here are the main parts:

Transportation mode: Air, ocean, and land shipping cost different amounts. Air is fast but costs more. Ocean is slow but cheaper for big items.

Distance and route: Longer trips cost more money. Busy routes can have better prices.

Seasonality: Prices go up during busy times, like holidays.

Cargo specifics: Size, weight, and special needs change the price.

Before main transit: You pay for cargo insurance, customs bonds, and booking fees.

Main transit: You pay ocean or air freight charges, war risk surcharges, and bunker adjustment factors.

Destination: You pay customs clearance fees, customs duties, and delivery fees.

Accessorial charges: These are extra fees for special services, like storage or extra handling.

You also pay customs duties, VAT, or GST, depending on the country. Each part shows up on your shipping bill. Check each one so you do not get surprised.

Package Consolidation Savings

You can save money by using package consolidation. This means you put many small shipments into one big shipment. You pay less for shipping and handling because you use space better. Warehousing helps keep and sort your stuff before combining. You see these savings on your shipping bill.

Fishgoo makes package consolidation simple. You can put items from different sellers into one box. This lowers freight charges and extra fees. Fishgoo uses digital tools to track your packages. You get cost comparisons and can pick the best shipping option. This helps you avoid extra shipping fees and keeps things easy.

Here is a table that shows how package consolidation saves you money:

Cost Saving Aspect | Description |

|---|---|

Reduced Freight Rates | You pay less per item when you ship more together. |

Lower Handling Costs | Fewer shipments mean less work and lower labor costs. |

Optimized Customs Clearance | Fewer entries can lower documentation and clearance fees. |

Decreased Packaging Requirements | You need less packaging, which cuts material costs. |

When you use Fishgoo, you get smart shipping and lower freight charges. You see all costs on your shipping bill, so you can control your spending.

Cross-Border Payment Fees

When you buy things from another country, you pay more than just the price and shipping. You also pay cross-border payment fees. These fees show up when you use a card, send money, or pay in another currency. It is important to know about these costs because they change how much you spend.

International Payment Fees Explained

International payment fees are extra charges you pay when you buy from a seller in another country. Banks, payment companies, and sometimes the shopping website add these fees. You might see them as cross-border payment fees, cross-border transaction fees, or surcharges on your bill. Each fee adds to your final cost.

Here is a table that shows the most common types of cross-border payment fees:

Fee Name | Description |

|---|---|

Transaction fee | A fee applied per transaction which can be a flat rate or percentage based. |

Currency exchange fee | Markup added to the exchange rate. It’s not always easy to spot but very common. |

Receiving bank fee | Some accounts may charge you to receive a cross border payment. If you’re a business owner who will regularly receive international payments, make sure you have an account without receiving fees. |

Intermediary fees | You may have to pay additional charges if the payment passes through multiple banks. |

Withdrawal fee | Some providers may charge you a fee when you withdraw the money from that account. |

You often pay a currency conversion fee when you use another currency. This fee comes from the difference between the rate you see and the real mid-market rate. The mid-market rate is the true value between two currencies. Banks and payment companies often add a markup. This markup is a hidden cost. You also pay wire transfer fees if you send money from your bank. These fees can be high, especially if the payment goes through many banks.

Surcharges can show up if you use certain cards or payment methods. Some websites add extra charges for using international cards. You might also see foreign exchange fees, which are extra costs for changing money from one currency to another.

According to Laura Galdikienė, Chief Economist at ConnectPay, "Cross-border payment challenges increase costs and cause delays that can reduce profit margins and disrupt cash flow. This often results in shipment delays and can complicate timely payments to vendors and employees."

International payment fees change your total cost in many ways:

International payment fees make business costs go up and make pricing harder.

Businesses can lose 3-5% of their transaction value because of confusion and extra costs from unclear fees and exchange rates.

High transaction costs and changing exchange rates can make businesses change their prices, which makes their products less competitive in the global market.

You need to watch for these fees because they add up fast. If you do not pay attention, you might spend more than you planned.

Reducing Transaction Costs

You can lower your cross-border payment fees by using smart ideas. Many shoppers and businesses look for ways to save money. Here are some of the best ways to reduce your cross-border transaction fees and get more fx fee savings:

Strategy | Description |

|---|---|

Use multi-currency accounts | Maintaining bank accounts in multiple currencies reduces foreign exchange exposure and lowers transaction costs. |

Leverage automated FX risk management | Implementing FX hedging strategies helps lock in favorable exchange rates and reduces exposure to market volatility. |

Optimize payment routing | Finding the most efficient payment routes can reduce transaction fees and speed up settlements. |

Ensure regulatory compliance | Automating compliance processes can improve efficiency and reduce the risk of penalties. |

Strengthen supplier relationships | Clear communication with suppliers can mitigate payment-related issues and foster trust. |

Monitor payment performance | Using analytics to track payment performance helps identify inefficiencies and optimize workflows. |

You can also look for websites that support many payment methods and show real-time exchange rates. Fishgoo helps you save on cross-border payment fees by offering many global payment options. You can pay with PayPal, Visa, MasterCard, and local payment methods. Fishgoo also supports UnionPay, WeChat, Alipay, and Western Union. This lets you pick the best way to pay and avoid extra surcharges.

Fishgoo uses the mid-market rate for currency conversion. You see the real cost before you pay, so there are no hidden currency conversion fee markups. This helps you get more fx fee savings and manage your budget. Fishgoo also keeps wire transfer fees low by working with trusted partners and offering local payment options.

Here is a table that shows how Fishgoo supports global payments and real-time exchange rates:

Payment Method | Description |

|---|---|

PayPal | Works with Visa, MasterCard, bank transfer, and other cards. |

VISA and MasterCard | Accepted from banks around the world. |

Local payment options | Allows payment in your own currency. |

UnionPay, WeChat, Alipay | Popular Chinese payment methods, including bank wire transfer. |

Western Union | Pay with cash at a store or send money online. |

Fishgoo’s system uses the mid-market rate for every transaction. You get clear prices and avoid hidden surcharges. This helps you get more fx fee savings and keeps your cross-border payment fees under control.

You can also save by combining payments or using multi-currency accounts. If you shop often, ask your bank about accounts that do not charge receiving bank fees or wire transfer fees. Always check if the website uses the mid-market rate for currency conversion. This step gives you the best value and more fx fee savings.

Tip: Always check the payment summary before you confirm your order. Look for any extra surcharges, currency conversion fee, or wire transfer fees. If you see a big difference from the mid-market rate, ask the website for details.

You can take control of your cross-border payment fees by staying informed and picking the right payment methods. Fishgoo’s clear system, real-time exchange rates, and many payment choices help you shop smarter and save more.

Identifying and Comparing Fees

Reading Fee Schedules

You need to know how to read a fee schedule before you shop internationally. A fee schedule lists all the charges you might pay. You can find this information on the website of the cross-border agency or payment provider. Look for a section called "Fees," "Pricing," or "Terms and Conditions."

When you read a fee schedule, check for these details:

The types of fees you will pay, such as service fees, shipping fees, and payment processing fees.

The percentage or flat rate for each fee.

Any extra charges for special services, like package consolidation or insurance.

Currency conversion rates and how they are calculated.

A clear fee schedule helps you plan your budget. You can compare the total cost before you buy. If you see all the fees listed in one place, you can trust the platform more.

To compare fee structures across different agencies, follow these steps:

Choose the right payment processor. Look for one that shows all fees clearly and offers fair exchange rates.

Negotiate with your providers. Use your transaction history to ask for better rates.

Use a unified payment data platform. This tool lets you track and compare fees from different providers in one place.

Spotting Red Flags

You should watch for warning signs when checking fee schedules. Some agencies hide fees or use confusing language. This can lead to surprise charges later.

Here are some red flags to look out for:

Vague terms like "additional charges may apply."

Fees that are not explained or broken down.

No mention of currency conversion rates.

Sudden changes in the total price at checkout.

Lack of customer support for fee questions.

Tip: If you cannot find a full list of fees or if the information seems unclear, consider using a different platform. Clear and honest fee schedules protect your money and help you shop with confidence.

Managing and Negotiating Costs

Bundling Services

You can save money by bundling services when shopping across borders. Bundling means you put many products or services into one order. This helps lower shipping costs because you send more things at once. Shipping companies often charge less for each item if you ship in bulk. Shopping this way is also more efficient.

Bundling lets you ship more products in one order, which lowers the total shipping cost.

Bigger orders help you pay less for each item, so you get more value.

Some countries have de minimis rules. If your package is under a certain value, you do not pay extra taxes or duties. This rule helps you avoid surprise fees and makes shopping from other countries better.

Fishgoo lets you bundle packages from different sellers. You can wait for all your items to reach the warehouse, then ship them together. This gives you more control over your spending and helps you skip hidden charges.

Tip: Always see if your agency gives free consolidation. This can help you save a lot on your bill.

Negotiation Tips

You can also save money by talking with agencies and suppliers. Good negotiation helps you get better deals and pay less in fees. Here are some steps you can use:

Check the market. Know what prices are before you start.

Set clear goals. Decide what you want from the deal.

Build trust. Good relationships can mean better prices.

Buy more at once. Bigger orders often get discounts.

Ask for flexible payment. Try to find terms that work for both sides.

Compare offers. Look at deals from different suppliers to find the best one.

Show how lower prices help both sides.

Ask about extra services or better shipping, not just price.

Be willing to compromise. Being flexible can help you get a good deal.

Finish the deal clearly. Make sure all terms are written down.

You can also set clear goals, work as a team, and learn about any legal or cultural rules. Sometimes, getting help from experts makes things easier. By using these tips, you can control your cross-border shopping costs and get the most out of every purchase.

Leveraging Technology for Clarity

Tracking Charges

You can use technology to watch every charge when you shop across borders. Many websites now have tools that help you see where your money goes. These tools show each fee, like product price, shipping, and payment processing. You get a clear view of your total cost before you pay. Some platforms, such as XTransfer, work with trusted banks. They give you real-time currency conversion and fast payment processing. This means you always know the exact amount you spend. Technologies like ISO 20022 make things even clearer. They set rules for how data moves between banks and let you track payments as they happen. You can see when your payment leaves your account and when it gets to the seller.

Here are some ways technology helps you track charges: Real-time payment tracking, instant currency conversion updates, detailed breakdowns of every fee, and alerts for any changes in charges. These features help you avoid surprises and keep your budget safe.

Using Transparency Tools

Transparency tools help you understand fee structures more easily. Many shoppers want to see all duties and taxes before they pay. In fact, 47% of international shoppers feel more confident when these costs show up at checkout. You can use tools that show correct product classification, country-specific tax rules, and prepaid fees like Delivered Duty Paid (DDP). Automation tools also help brands figure out the total landed cost in real time. They use current trade rules and tax rates, so you get the right price every time. This lowers mistakes and keeps your money safe.

Here are some key features of transparency tools: Accurate product classification (HS codes), country-specific tax schemes, and prepaid fees (DDP) shown at checkout.

Note: When you use platforms with these tools, you make smarter choices and avoid hidden costs. Technology helps you shop with confidence and clarity.

You can handle cross-border agency fees by learning about payment gateways. Try to get better rates by talking with agencies. Pick platforms that show prices clearly. Fishgoo lists every fee before you pay. This helps you avoid surprises and plan your budget. Check your agency agreements when you renew contracts or review performance. Use tools to watch your costs and stop hidden fees.

Be ready for shopping by getting your documents, comparing carriers, and looking for hidden charges.

Description | Prevention Suggestions | |

|---|---|---|

Document Fee | Manual review costs | Ask for all-inclusive pricing before you pay |

Storage Fee | Delays from customs | Make sure your documents are correct and pre-declare items |

Inspection Fee | Random checks | Use packing lists that follow the rules |

FAQ

What is a transparent fee structure?

A transparent fee structure lets you see all costs first. You know the price, shipping, and service fees right away. This helps you plan your money and stops surprises.

How can you avoid hidden fees when shopping internationally?

Always check the full fee list before you buy anything. Pick platforms that show every charge before you pay. Fishgoo lists all fees, so you know your total cost.

Why do cross-border payments have extra fees?

Banks and payment companies add fees for moving money. These fees pay for currency exchange and sending money to other countries. You see these charges on your payment summary.

How does package consolidation save you money?

Combining many packages into one shipment lowers shipping costs. Fishgoo gives free consolidation, so you pay less for shipping.

What payment methods does Fishgoo support?

Fishgoo lets you pay with PayPal, Visa, MasterCard, UnionPay, WeChat, Alipay, or Western Union. You can pick the way that works best for you.

See Also

Maximizing Your Global E-Commerce Logistics For Cross-Border Success

A Comprehensive Guide To FISHGOO Shipping Fees And Savings

A Complete Guide For International Students Shopping On Taobao

Navigating International Shipping From Chinese Sites: Costs And Options

Evaluating FISHGOO Agent: Benefits, Drawbacks, And Service Quality