How Shared Payment and Channel Access Drives B2B Growth

You see shared payment and channel access change how b2b platforms work. These solutions help you and your clients make payments easier. They also open new chances for buyers all over the world. With smooth payment integration, you get real-time transactions. You also get money faster, which helps your business grow. Fishgoo helps you grow worldwide. It makes it easier for buyers to find Chinese products. Think about how using these ideas can fix your b2b problems. They can also help your business get bigger.

Statistic Description | Value | Growth Rate |

|---|---|---|

Projected market size by 2032 | 35.4% CAGR | |

Global transactions in 2023 | 266.2 billion | 42.2% increase |

Key Takeaways

Shared payment systems make transactions faster. Businesses get money quicker. This helps improve cash flow.

Flexible payment options make customers happier. Buyers have more ways to pay. This can help increase sales.

Transparent payment processes build trust. This helps make strong relationships with buyers and partners. It can lead to long-term success.

Working with local experts helps businesses enter new markets. It is faster and costs less.

Automating payment processes lowers mistakes and saves time. Businesses can focus on growth and keeping customers loyal.

B2B Payment and Channel Challenges

Common Issues in B2B Payments

Handling embedded b2b payments on b2b platforms can be hard. Manual invoice mistakes slow down how fast you get paid. Waiting for approvals can make your cash flow slower. Every client may want a different way to pay or get invoices. Big payments and long wait times can hurt your money situation. Doing payments by hand takes more time and can lead to errors.

Tip: If you automate embedded b2b payments, you can stop delays and mistakes. You will track payments faster and keep your records right.

Here is a table that shows common problems in b2b payment workflows:

Pain Point | Description |

|---|---|

Errors on manual invoices | Mistakes when doing things by hand can slow down payments. |

Untimely approvals | Slow approvals can hurt your cash flow. |

Vendor management | Getting vendor details takes a lot of time. |

Managing multiple vendor portals | Getting payment info from many systems is not easy. |

Unstructured remittance advice | It is hard to match payments with messy information. |

Misaligned incentives | Buyers want to pay late, but sellers want money fast. |

You also have to deal with long checks and not enough ways to pay. Only a few businesses think their embedded b2b payments work really well. Failed payments can make your team work more and hurt vendor relationships. Many vendors give fewer discounts or stop working with clients who pay late. You need good embedded b2b payments to keep your business running well.

Channel Barriers in B2B E-Commerce

You face channel barriers when you try to grow your b2b ecommerce business. Bad infrastructure and not knowing how to use digital tools can stop new buyers. Buyers worry about trust and safety on b2b ecommerce platforms. Rules and laws can make it hard for you to do business. Money problems and tech issues can also slow your growth.

Other brands can take attention away from your products.

Dealers often control customer data, so you cannot always reach buyers.

Bad communication with partners can make teamwork hard.

Prices that change and sales areas that overlap can cause fights.

Bank-fintech partnerships help you get past these problems by giving safe embedded b2b payments and better ways to reach buyers worldwide. Fishgoo uses these partnerships to make payment and channel management easier. You can find more buyers and meet what b2b buyers want today. This helps your b2b buying and lets you grow in the b2b e-commerce market.

Shared Payment for B2B Growth

Streamlining Transactions

You want your business to be fast. Shared payment helps you do this. With shared payment, you get real-time processing. You can send and get money right away. You do not have to wait days for your money. Your cash flow gets better, so you can act quickly. Fishgoo uses shared payment for easy checkout. You see your balance and transactions right away. This makes checkout simple and smooth.

Here is how shared payment helps your business move faster:

Benefit | Description |

|---|---|

Real-time payments let you pay and get paid right away. This cuts down the time it takes for payments. | |

Improved Cash Flow | You get your money fast, so your cash flow is better. You do not need to keep a lot of extra cash. |

Enhanced Transaction Visibility | You can see your balance and payments in real time. This helps you make quick choices. |

Real-time payments help you skip delays and lower costs.

You can pay or get paid close to the due date, which saves time.

Reporting tools help you see your cash and speed up payments.

Shared payment gives you easy transactions. You spend less time on paperwork. You have more time to grow your business. This is how payment helps you grow on b2b platforms.

Flexible Payment Options

Flexible payment options change how you work. You can give buyers many ways to pay. This includes PayPal, credit cards, and local ways. Fishgoo lets you use flexible payment options for clients worldwide. You can match payments with your sales cycles. This helps during busy times or when things change.

Many b2b groups see that flexible payment builds strong customer ties.

Split payments help you keep more clients.

Buyers like paying when it works for them.

Flexible payment helps your business in tough times.

47% of b2b firms say better checkout is their top goal.

Flexible payment makes checkout faster and easier.

Buy Now Pay Later can boost sales by up to 25%. This means more sales and more money for you.

Flexible payment keeps buyers happy and loyal.

You can use flexible payment to help your business grow.

Flexible payment also helps buyers from other countries. You get tools to follow rules and keep data safe. The system is easy and helps with cross-border payments. You can cut costs and avoid hidden fees. Fast payments help you keep good supplier ties. You see clear prices and exchange rates, so you can plan better.

Feature | Description |

|---|---|

Helps you follow rules like AML and KYC, keeping data safe. | |

Ease of use | Simple tools and automation make cross-border payments easy. |

Risk mitigation | Gives you tools to handle changes in exchange rates and world events. |

Customer support | Gives you help from people who know about global markets. |

Costs | Tries to lower fees and hidden charges, saving you money. |

Speed | Makes payments faster, so your cash flow and supplier ties are better. |

Transparency | Shows clear prices and exchange rates, so you can plan your money. |

Scalability | Grows with your business using flexible prices and services. |

With flexible payment, you make checkout easy. You give buyers the choices they want. This makes your checkout better than others.

Enhancing Trust and Transparency

Trust is important in b2b deals. Shared payment helps you build trust with buyers and partners. You get clear, real-time updates on payments. You do not have to guess if a payment worked. Cloud platforms like Fishgoo show every step of the payment. This makes checkout more open.

Shared payment moves you away from old systems where you could not see payment status.

You see payment times and costs right away, which builds trust.

Instant payments cut delays and help you manage your money.

Clear payment options make your business worth more and make partnerships stronger.

Shared payment also helps stop fraud and fix problems. Automated tools find issues early. You can fix them before they get big. This saves you time and money. You feel safe knowing your payments are protected.

When you use shared payment, you show buyers you are honest and open. This trust helps your business succeed for a long time.

Channel Access and B2B E-Commerce Expansion

Unlocking New Markets

You can get into new markets faster with integrated channel strategies in b2b e-commerce. Platforms like Fishgoo help you use many online and offline channels. This lets you sell in other countries without hiring big teams. Partners give you local knowledge about each market. You also save money because partners help pay for sales and marketing. The table below shows how these strategies help you grow:

Benefit | Explanation |

|---|---|

Scalability | You can grow fast in new places by using partner networks. |

Cost-Efficiency | You spend less to get new customers and get better returns. |

Local Expertise | Partners help you learn what each market needs. |

Extended Reach | You work with partners in many areas to grow your brand. |

Faster Market Entry | You use partners’ customers to launch faster. |

Increased Customer Trust | Buyers trust you more when you work with local partners. |

Partner Collaboration

You can make your b2b e-commerce business bigger by working with partners. Sharing channels helps you give buyers a better experience and find more customers. You can also get leads faster by doing marketing together. Here are some ways working with partners helps:

You make the customer experience better.

You reach more buyers in new places.

You find end customers by using partner networks.

You help partners with training and support.

To work well together, pick partners who want the same things. Talk often and clearly. Set goals and give rewards. This builds trust and helps everyone do well.

Increasing Sales Reach

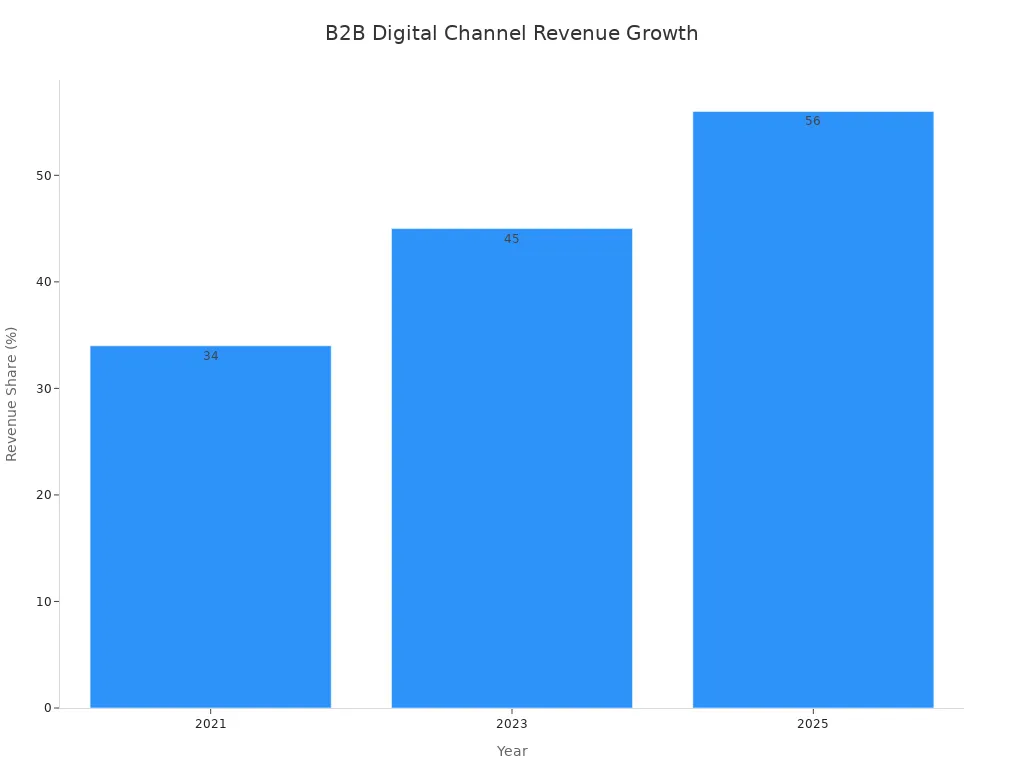

Using many channels helps you find more buyers and sell more in b2b e-commerce. You can use websites, apps, and stores. More money now comes from digital channels:

Year | Revenue from Digital Channels |

|---|---|

2021 | 34% |

2023 | |

2025 | 56% (projected) |

You can check your progress by looking at sales, lead value, and what customers say. Companies using mobile CRM apps hit their sales goals more often. When you use more channels, you meet buyers at the best time and place. This helps you sell more and build stronger relationships in b2b e-commerce.

Driving Revenue Growth in B2B

Operational Efficiency

You want your business to work well and save money. Shared payment and channel access help you do this. When you use b2b platforms like Fishgoo, you can set up order capture and contract pricing to run by themselves. This means fewer mistakes and faster orders. You do not have to type in the same data again or fix as many errors. You also get paid faster, so your money comes in sooner.

Here is a table that shows how these changes help your business:

Description | Impact on Efficiency |

|---|---|

Orders go faster and have fewer mistakes | |

Integration with channels and systems | Costs go down and you can grow easier |

No need for manual reconciliation | Less help needed and fewer problems |

Automated credit checks and clean data | Shorter wait times and faster payments |

Self-service reordering and accurate terms | Bigger orders and happier buyers |

Multi-site setups for new markets | Fewer workers needed and less risk |

Digital platforms for all steps | Lower costs and faster money cycles |

When you spend less and get paid faster, you see more profit. You can use this money to try new products or go into new markets.

Customer Loyalty

You want your buyers to come back again and again. Shared payment and channel access help make this happen. When you give buyers easy ways to pay, they trust you more. They like fast checkouts and clear info. You can also give special rewards to thank buyers who return. This makes your bond with them stronger and helps your business earn more.

The table below shows how these ideas help keep buyers loyal:

Element | How It Helps Loyalty |

|---|---|

Buyers feel special and want to return | |

Seamless user experience | Clients like easy payments and returns |

Effective communication | Buyers trust you and come back for more |

Data analytics | You learn what buyers want and give it |

When you focus on loyalty, you make more money and see better results. Happy buyers tell their friends, so your business grows even more.

Real-World Success

Fishgoo is a good example of how shared payment and channel access help you earn more. Many b2b companies using Fishgoo say they get paid faster and make more money. You can go into new markets with less worry and find more buyers. Fishgoo’s platform lets you handle payments, watch orders, and help clients all over the world.

Note: Companies using digital platforms for payment and channel access can get paid up to 30% faster and see 20% more revenue. You can see better results by making payments simple and using many channels.

Here are steps you can follow to grow your revenue:

Make your payment process automatic.

Use many channels to find more buyers.

Give rewards to buyers who come back.

Check your revenue and results often.

When you use these ideas, your business can keep growing for a long time.

Implementing Shared Payment and Channel Strategies

Assessing Current Processes

You need to know how your business handles payments and channels before changing anything. First, draw out your payment steps and write down all the costs. Talk with your team and clients to learn what works well and what does not. Decide what you want to improve, like lowering payment costs or making payments faster.

Here is a simple table to help you check your process:

Step | Description |

|---|---|

1 | Draw your payment steps and write down costs. |

2 | Talk to people to learn what works and what does not. |

3 | Decide what success means for your payments. |

Look for jobs that take too much time from your staff. Find any slow spots in your payment steps. Check if your systems depend on each other and slow things down. Doing this helps you see where you can do better and gives you a good start for growing.

Choosing Solutions

When you pick a new payment system for your b2b platform, focus on what is most important. Look for payment terms that fit what your buyers need. Fast approval for financing helps new buyers buy quickly. Make sure the payment system works with your current tools. Good risk management keeps your money safe. Pick solutions that work for all kinds of buyers and clients.

Criteria | Description |

|---|---|

Gives different terms for different buyers. | |

Quick Financing Approval | Gives fast approval so buyers can buy quickly. |

Integration with Existing Systems | Works well with your current business tools. |

Helps keep your money safe from risks. | |

Accommodating Different Segments | Works for all your buyers and clients. |

Fishgoo follows these best ways. The platform lets you use many payment types and connects with channels around the world. This makes it easier to help buyers from many places.

Building Partnerships

You can grow your business faster by working with strong partners. Work with partners you trust and who know your market. Share payment and channel access to reach more buyers. Teach your partners about your products and payment steps. Set clear goals and rewards for your partners. Good talks help everyone stay on track.

Tip: Pick partners who share your values and want to help you win. Meet often to fix problems early.

Fishgoo works with top leaders to give shared payment and channel access. This helps you get into new markets and support your clients better.

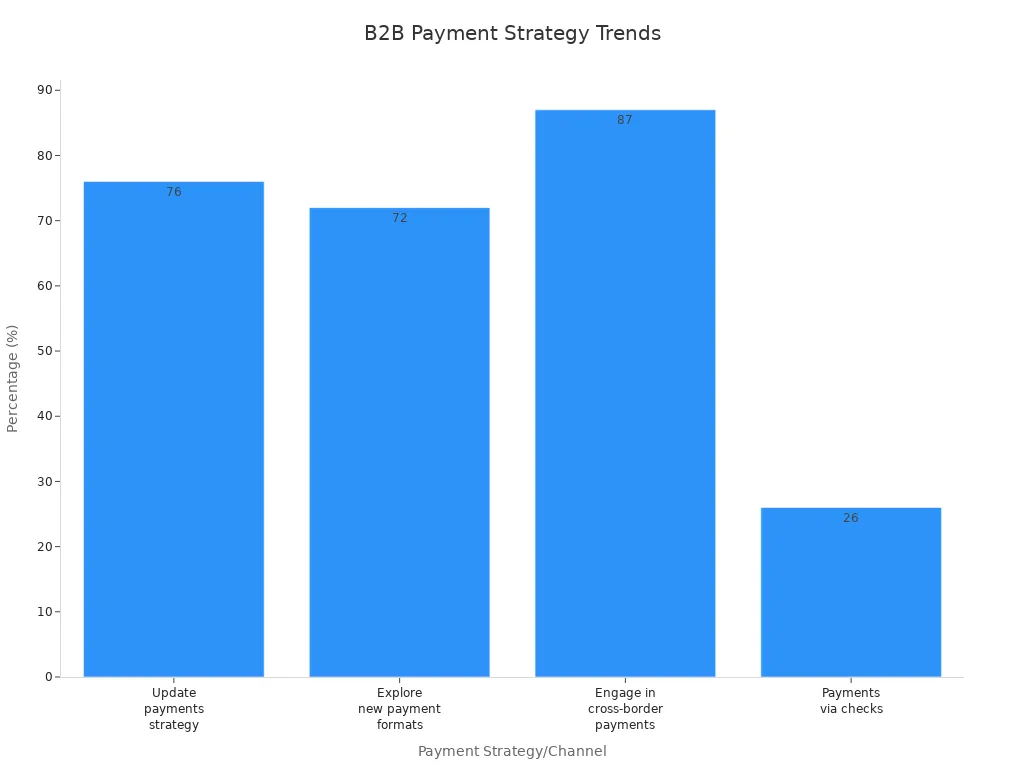

You can help your b2b business grow with shared payment and channel access. These tools let you find more buyers and make paying easy for your clients. Many companies want to change how they handle payments and try new ways to sell. Look at these numbers:

Statistic/Insight | Percentage/Value |

|---|---|

Organizations planning to update payments strategy | 76% |

Organizations exploring new payment formats and channels | 72% |

Organizations engaging in cross-border payments | 87% |

B2B payments via checks | 26% |

Platforms like Fishgoo help you collect payments automatically, pay less in fees, and keep buyers safe. You can see every payment as it happens and help your clients trust your b2b platform. Try using shared payment and channel ideas to help your business get bigger.

FAQ

How does shared payment help my B2B business?

Shared payment lets you process transactions quickly. You see real-time updates. You reduce errors and save time. Your cash flow improves. You build trust with buyers.

What payment methods can I use on Fishgoo?

You can use PayPal, Visa, MasterCard, Alipay, Apple Pay, and many local options. Fishgoo supports global payment channels. You choose what works best for you.

Payment Method | Supported? |

|---|---|

PayPal | ✅ |

Visa/MasterCard | ✅ |

Alipay | ✅ |

Apple Pay | ✅ |

Local Methods | ✅ |

Can I combine orders from different sellers?

Yes, you can. Fishgoo lets you consolidate items from multiple sellers into one parcel. You save on shipping costs. You manage everything in one place.

Tip: Use package consolidation to lower your shipping fees.

How do I track my order status?

You log in to your Fishgoo account. You check the "My Orders" and "Warehouse" sections. You see updates for each step. You get tracking numbers for parcels.

Is my payment information safe on Fishgoo?

Fishgoo uses secure payment systems. You get protection for your data. You see clear payment records. You can contact support if you have questions.

See Also

Maximizing Cross-Border E-Commerce Logistics For Worldwide Growth

Monetizing Video Sharing: Tips For FISHGOO's Coupon Program

The Importance Of International Warehousing For Business Growth

Comprehensive Overview Of JD Purchasing And Forwarding Services

FISHGOO Revolutionizes Global Shopping By Connecting With Chinese Products